August 12, 2025

This report was updated on August 22, 2025 to incorporate additional details on K-12 Education.

by Lily Padula

On May 31, the Illinois General Assembly passed three budget bills for the 2026 fiscal year: the appropriations bill, which authorizes how state funds will be spent; the budget implementation bill, which makes necessary legal changes to carry out the budget; and the revenue omnibus bill, which adjusts tax laws and revenue sources to fund the spending plan. The governor signed them into law on June 16. This budget marks the first full cycle without pandemic-era federal support, combined with a change in federal administration that has created new uncertainties regarding future funding flows. This fiscal ambiguity complicated the budget process from the outset.

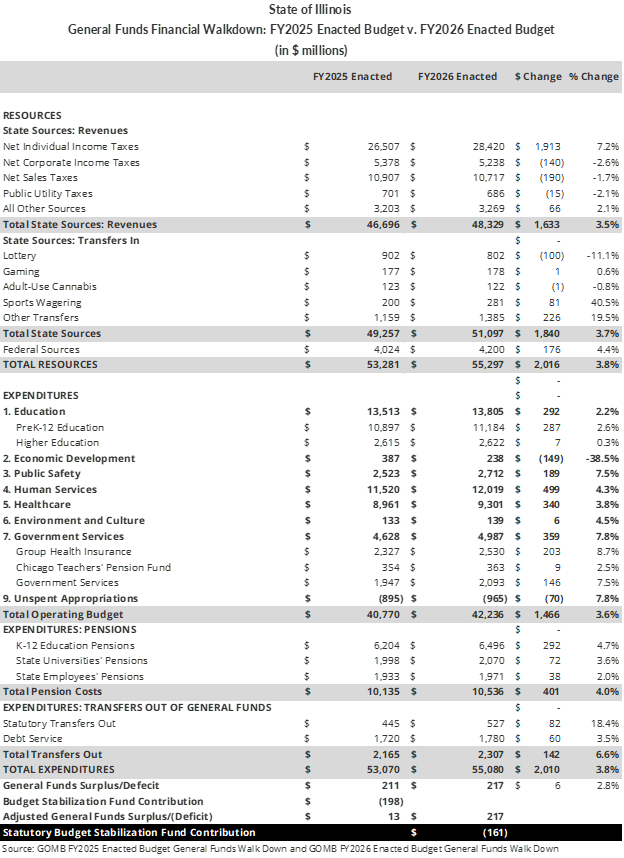

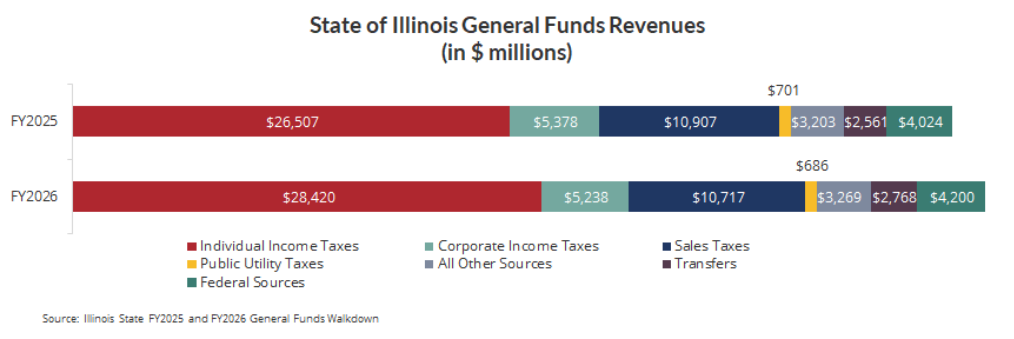

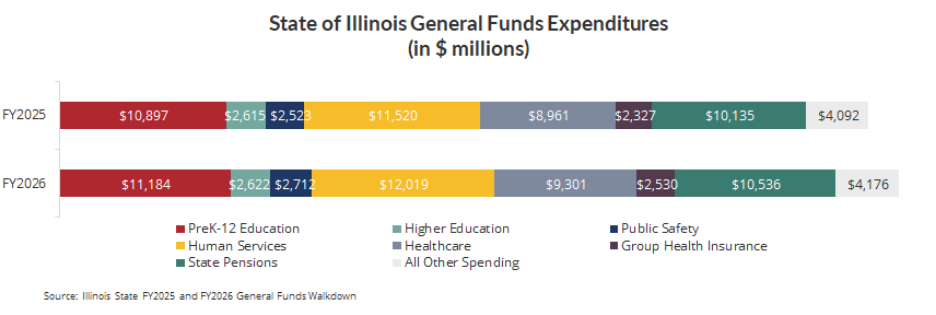

The State’s FY2026 enacted budget primarily builds on the previous year’s spending plan with modest increases in both revenues and expenditures. General funds appropriations and revenues rose by 3.8% compared to FY2025. The table below reports the details. While the budget remains balanced on paper, it relies on targeted revenue increases and one-time fiscal maneuvers to close emerging gaps. Furthermore, the enacted budget does little to advance priorities previously emphasized in the Civic Federation’s earlier work, including:

- Avoiding structural imbalances,

- Building rainy day fund reserves,

- Budgeting collaboratively with local governments, and

- Managing long-term liabilities, including unfunded pension liabilities.

Given the ongoing uncertainty surrounding federal fiscal support and related policy developments, the enacted budget leaves several major issues unresolved. It does not account for emerging pressures including the unresolved transit funding shortfall for the public transit agencies in northeastern Illinois, reductions in federal funding for Medicaid, environmental and climate initiatives, and research support for public universities. These broader challenges may also coincide with fiscal pressures at the local level, such as those facing the City of Chicago and Chicago Public Schools. As such, policymakers may need to revisit and revise the budget as these issues continue to develop.

Revenue Projections and Forecast Adjustments

Illinois’ expectations for FY2026 revenues changed multiple times before the budget was finalized. This is not unusual and reflects generally the greater capacity for precision as the end of the then current fiscal year approaches. This year, what started as a $3 billion projected deficit in November 2024 was gradually closed through updated forecasts and the adoption of expanded or new taxes, fund sweeps, and delayed transfers. In February 2025, the proposed FY2026 budget projected $55.45 billion in General Funds Revenue, reflecting a 4.1% increase over the FY2025 enacted budget revenue base. This projection included approximately $498 million in proposed new revenue. In mid-May, these revenue projections were lowered by approximately $536 million (about 1%). This revision was attributed largely to economic uncertainty and reduced federal funding, with income and sales tax revenues lowered by 1% and corporate income tax expectations dropping nearly 7%. The final FY2026 budget reflected $55.3 billion in General Funds Revenue, with over $1 billion in new revenue including over $700 million in new or expanded taxes and over $500 million in one-time revenues such as fund sweeps and delayed transfers.

Revenue Changes

Illinois anticipates bringing in more revenue in FY2026 compared to FY2025. However, this is not just because of a stronger economy. This budget cycle, legislators passed a range of new tax and one-time measures to help cover rising costs, increased expenditures, and the end of pandemic-era funding. Most of the additional revenue comes from these one-time sources and tax changes, with only a modest share attributable to natural growth in existing revenues.

New and Expanded Taxes

Corporate Tax Changes

As part of the FY2026 budget, Illinois made changes to how businesses are taxed in the state. Beginning with the 2025 tax year, 50% of certain international profits earned by U.S.-based corporations, known as Global Intangible Low-Taxed Income (GILTI), will be taxed. By including a portion of this income in the tax base, the State can reduce tax avoidance and ensure more equitable taxation of multinational corporations. This change is expected to generate around $200 million for the state’s General Fund and another $70 million for the Personal Property Replacement Tax which generally flows down to local governments for operations.

A second change made was the way Illinois calculates the amount of a multi-state corporation’s income that is taxable in the state. Under the new method, known as the Finnigan approach, companies that do business in multiple states must include the sales of their affiliated companies (even those not directly taxed in Illinois) when determining the share of their overall income subject to tax. This change is expected to increase FY2026 state revenues by $72 million to the General Fund and about $25 million to the Personal Property Replacement Tax. It brings Illinois in line with other states that use a broader formula to prevent companies from shifting income away from higher-tax jurisdictions.

The FY2026 budget removes two tax exemptions that previously allowed certain businesses to reduce their taxable income by subtracting interest expenses:

- The non-tax avoidance exemptions, which was for interest expenses that weren’t part of a strategy to avoid taxes, and

- The subject-to-tax exemption, which was for interest paid to a lender that had to pay tax on that income.

Now, businesses must add back more of their interest expenses when calculating their taxable income. Additionally, if a business can’t deduct all its interest, the rules now say it must apply the disallowed portion to non-foreign lenders first (e.g., U.S.-based lenders) before applying it to foreign ones. This change is projected to raise $80 million for the General Fund and about $28 million for the Personal Property Replacement Tax.

The budget also updates how Illinois taxes gains and or losses from the sale of pass-through entities (like partnerships or S-corporations). Under the new rule, the amount of gain or loss taxable by Illinois is based on the business activity (apportionment factor) of the pass-through entity within the state. So, if a pass-through business does most of its business in Illinois, then most of the gain from its sale will be taxable in Illinois.

Excise and Industry-Specific Tax Changes

The FY2026 budget includes several excise and industry-specific tax changes. A new sports wagering tax will apply to each bet placed in Illinois: the first 20 million wagers will be taxed at $0.25 per bet, and any additional wagers will be taxed at $0.50 each. This tax is only applicable to online sports betting, in-person betting will not be subject to this new tax. While the Governor’s Office estimates this change will generate $36 million, industry projections suggest it could raise up to $160 million based on betting volume.

The budget also updates the Tobacco Products Tax, expanding the definition of taxable tobacco products and raising the tax rate to 45% of the wholesale price. This change simplifies the tax structure but increases the overall tax burden. Additionally, the annual license fee for tobacco retailers will double, increasing from $75 to $150.

Another change is to the Telecommunications Excise Tax, which will increase from 7% to 8.65%. Revenue from this increase will be directed toward supporting the 9-8-8 Suicide and Crisis Lifeline, a critical mental health service.

Sales and Use Tax Changes

Beginning July 1, Illinois will apply the Hotel Operators’ Occupation Tax (HOOT) to short-term rentals, such as those offered through platforms like Airbnb and Vrbo. This means short-term rental operators will now be taxed in the same way as traditional hotels.

Additionally, starting January 1, 2026, the threshold for requiring out-of-state businesses to collect Illinois sales taxes will change. Currently, businesses must collect the sales tax if they either make $100,000 in sales or have 200 transactions in the state each year. Under the new rule only the $100,000 sales threshold will apply, simplifying the requirement and removing the transaction count as a factor.

Tax Amnesty Measures

In an effort to increase collections, Illinois will offer several tax amnesty programs that give taxpayers a chance to pay back taxes without penalties or interest. The Department of Revenue will run a general tax amnesty program from October 1 through November 17, 2025. There will also be a franchise tax amnesty during the same timeframe, though it excludes taxpayers who have received interrogatories. Additionally, a special amnesty program for remote retailers will take place from August 1 to October 31, 2026, covering tax periods from January 1, 2021, through June 30, 2026. Remote retailers can still participate in the earlier 2025 amnesty if eligible. A key benefit of the 2026 remote retailer program is the options to apply a simplified tax rate, 9% for general merchandise and 1.75% for lower-rate items, rather than determining the exact rate based on each sale’s delivery location.

Delays and Sweeps

To help close the FY2026 budget gap, the State relied on several one-time financial strategies to increase available funding in the General Fund.

- One major step was delaying the fifth and final transfer of motor fuel sales tax revenues to the Road Fund, which kept $171 million in the General Fund.

- The enacted budget also postponed the scheduled monthly payment from the General Revenue Fund to the state’s Budget Stabilization Fund, Illinois’ “rainy day” fund, freeing up another $45 million. While other revenues will be directed toward the “rainy day” fund, the state’s year-end balance in FY2026 would still be far short of its target of 7.5% of general funds revenues.

- Additionally, the State swept a total of $271 million from 57 special-purpose funds and redirected those dollars to the General Fund. While such sweeps, which are commonly used in Illinois and tend to increase during periods of fiscal stress to help balance the budget in the short term, they do not provide a solution to the state’s structural deficit.

Expenditure Shifts

The FY2026 Illinois State Budget reflects targeted expenditure shifts across major service areas. The largest increases in expenditures are within Human Services ($499 million), Healthcare ($340 million), and PreK-12 Education ($287 million).

Education

Early Childhood Support Programs

In early childhood, the budget increased funding to support families and the workforce. This includes a $85 million (6.3%) increase for the Child Care Assistance Program, a $90 million (81.8%) increase for Smart Start Workforce Grants, and a $7.5 million (53.6%) boost for the new Department of Early Childhood. It also maintains $748 million for the ISBE Early Childhood Block Grant and invests $20 million in Early Childhood Workforce Compensation Contracts to stabilize the provider workforce.

K-12 Education

In K-12 Education, the budget includes a $307 million increase through the Evidence-Based Funding (EBF) formula, $7 million of which is allocated to newly established Alternative/Safe Schools. This is less than recent annual increases that were closer to $350 million due to the elimination of the Property Tax Relief Grant. Additional investments in line with previous years include $1.3 million for career and technical education programs, $35 million for after-school programming, and targeted efforts to address the teacher shortage: $5 million for a teacher mentorship program, $30 million for the Teacher Vacancy Grant Pilot Program, and $8 million for the Minority Teachers of Illinois Scholarship.

Higher Education

Higher education receives a 1% funding increase, with the potential for an additional 2% increase in FY2026 if substantial federal funding is eliminated. The budget allocates $721 million to the Monetary Award Program (MAP) which provides financial aid to Illinois residents, a $10 million increase from last year, and $50 million to the AIM High Grant Program. It also includes $2.5 million for the Common Application Partnership Initiative to streamline the college application process. However, funding for the Illinois Community College Board decreases by $24 million due to reduced spending on a workforce development grant program that saw lower-than-anticipated participation or demand.

Healthcare

Healthcare and human services represent a major area of spending, with a total allocation of $45.3 billion from all funds, including $9.36 billion from General Funds and $36.9 billion for Medicaid—a $738 million increase from last year. The budget includes $600 million for safety net hospitals, $100 million for a new child tax credit for low-income families with the Earned Income Tax Credit (EITC), and $15 million for the Medical Debt Relief Pilot Program. It also provides $268 million for the HOME Illinois initiative to address homelessness and increases funding for medical assistance programs by $1.7 billion, now covering 3.5 million Illinoisans. Mental and behavioral health services receive a $191 million increase, with additional investments in the Pathways to Success program ($132.8 million) and in-state psychiatric residential treatment facilities ($27.7 million). The budget also increases support for people with developmental disabilities and maintains funding for substance abuse treatment and prevention. However, it includes a cut to state-funded healthcare coverage for undocumented immigrants aged 42 to 65 ($487 million), while expanding services for children and seniors.

Pensions

Pension funding is another key component of the budget. With the enacted budget, the State fully funds the certified pension contribution, which is the amount required by statute under Illinois’ 50-year funding plan. The pension contribution for the five state-run pension funds totals $11.7 billion, of which $10.5 billion comes from the General Fund. However, this certified amount is significantly lower than the actuarially determined contribution of $16.8 billion, which represents the amount needed to keep the systems on a more sustainable trajectory. The continued gap between the statutory requirements and actuarial best practices means that the State is meeting its legal obligations but still falling short of what would be needed to prevent the growth of unfunded pension liabilities over time.

Additionally, the enacted budget sets aside $75 million to support potential adjustments to the Tier 2 pensionable salary cap. This fund aims to support efforts to align the Tier 2 pension structure with the Social Security Safe Harbor rule, and is an action the Civic Federation supports.

Economic Development

The FY2026 budget includes significant investments in economic development, site readiness, and industry support initiatives. A total of $200 million is allocated for historic site readiness efforts, including the Surplus to Success program and the Department of Commerce and Economic Opportunity’s (DCEO) site readiness initiative. Additional funding supports business recruitment, workforce training, economic assistance, and tourism promotion, with $40 million designated for the Rebuild Illinois Enterprise Fund, $24 million for manufacturing training academies, $75 million for the Prime Sites Capital Grant Program, and $1.5 million for the Made in Illinois program. The budget also includes $5 million to support NASCAR events and $1 million to assist the PGA Tour in hosting the 2026 President’s Cup in DuPage County.

Several tax credit programs are being expanded as part of the economic development strategy. While these changes have limited short-term fiscal impact on the FY2026 budget, they may have significant long-term implications. The new Advancing Innovative Manufacturing (AIM) Tax Credit offers up to 7% on eligible capital investments. The Quantum Computing Campuses Tax Credit lowers the minimum land size requirement from half a square mile to 100 acres, expanding eligibility. The Reimagining Energy and Vehicles (REV) program broadens to include industries such as green steel, electric aircraft propulsion, and nuclear energy. Other updates clarify qualifying providers under the Apprenticeship Education Expanse Credit, allow certain manufacturers to apply EDGE Tax Credits to withholding taxes, and expand the High Impact Business program to cover high-voltage direct current converter station projects.

BRIDGE Fund

A $100 million BRIDGE Fund is included to provide the Governor with emergency fiscal flexibility in case of federal funding cuts. The fund is intended as a contingency measure to help the State respond quickly to potential revenue losses without disrupting critical services.

Missing

However, some areas saw notable omissions or reductions. First, the enacted budget does not include any transit funding or related transit governance reforms for northeastern Illinois, whose agencies are facing a $770 million budget shortfall in FY2026 with the exhaustion of federal COVID-19 relief funds. Bills providing up to $1.5 billion in new transit funding stalled in the legislature at the end of the session. The failure to address the so-called “fiscal cliff” facing transit agencies suggests the difficulty in making good on a commitment to sustainable budgeting practices and collaboration with the state’s local governments and jurisdictions. The enacted budget also cuts $43 million from a grant program aimed at providing property tax relief to school districts with high tax rates and low property wealth. Additionally, the budget includes no additional funding for agricultural conservation programs such as the crop insurance discount program and does not include funding to backfill federal cuts to public universities for research. At the same time, the State maintained a fiscally prudent approach by declining to commit funds for a proposed new Chicago Bears stadium project and related infrastructure, avoiding a major, non-essential expenditure amid competing priorities.

Conclusion

The FY2026 budget reflects modest growth over the prior fiscal year, but with a more cautious approach to spending based on the revenue assumptions. Budget balance is achieved through a combination of new revenues, tax base expansions, strategic timing shifts, and one-time fiscal maneuvers that may not be sustainable in the future. While the budget remains balanced on paper, it does not fully account for several emerging challenges, including the unresolved public transit funding shortfall, expected reductions in federal support for Medicaid, environmental and climate initiatives, and research funding for public universities. At the same time, the State faces potential bottom-up pressures from looming local fiscal challenges at the local level, including a projected $1 billion deficit in the City of Chicago and an ongoing fiscal crisis in the Chicago Public Schools. Amid continued economic uncertainty, long-term planning and sustained fiscal discipline will be critical to maintaining stability in the years ahead.